This type of activity centre comprises persons or groups thereof in connection to which costs are ascertained. Whereas a centre whose performance we can measure through its income earning capacity is Profit Center. Both concepts are used in a business where senior management wants to drive responsibility down into the organization, so this cannot be considered a difference between the two concepts. As a company grows, it’s important to join together all of these various units with a central accounting system.

Contribution to revenue

If the center has the potential to generate significant revenue, a profit center may be a better choice. However, if the center is unlikely to generate substantial revenue, a cost center may be more appropriate. Invest in employee training to ensure staff members have the necessary skills and knowledge to perform their jobs effectively. It can include training in process improvement, financial analysis, and budgeting. To measure the performance of a cost center, we need to do a variance analysis through which we would be able to see the difference between the standard cost and the actual cost.

Implement Cost-Saving Measures – Strategies for Effective Management of Cost Centers

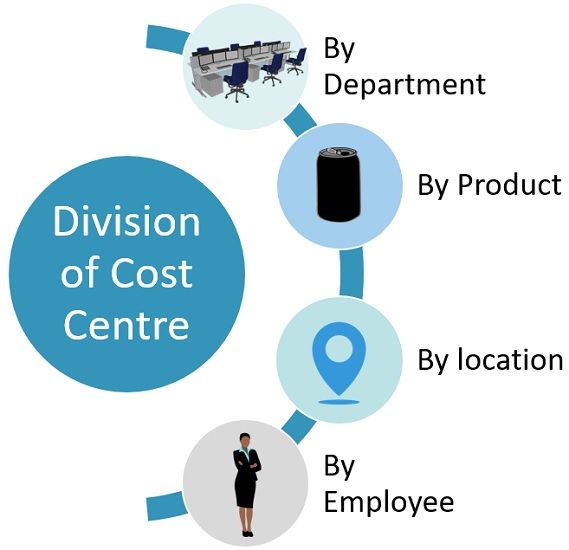

Transfer price is nothing but the value placed on the exchange of goods and services between two profit centres. And the way in which we determine this profit, will decide the profitability of the supplying (selling) and receiving (buying) profit centre. Keeping cost centers is important for long-term health and the organization’s perpetuity. As a result, the organization stops doing what doesn’t generate profits and starts doing more of what develops. Such an activity centre comprises of location, department or an item of equipment is an impersonal cost centre. And to calculate the cost of production of the respective cost centre, all the costs related to that particular activity would be accumulated separately.

Cost center vs profit center vs investment center

- These are responsible for generating profit be it through controlling cost or increasing revenue.

- A profit center, on the other hand, is a business unit or division within an organization that generates revenue and is accountable for its profitability.

- This empowerment not only drives financial performance but also encourages entrepreneurial thinking and innovation.

They do not generate revenue directly but are critical for operating expenses and improving profitability. Some examples of cost centers include accounting, human resources, and IT departments. Cost centers and profit centers are two fundamental concepts in business management that serve different purposes. While cost centers focus on cost control and efficiency, profit centers aim to generate revenue and maximize profitability. Understanding the attributes and differences between cost centers and profit centers is crucial for effective financial analysis, resource allocation, and decision-making within organizations.

Focus on Customer Satisfaction – Strategies for Effective Management of Profit Centers

The critical factor is whether the department minimizes costs or generates revenue. The primary objective of cost and profit centers is different, reflecting their distinct organizational roles. You won’t see a cost center and a profit center in a centralized company; since the company’s control is from a small team at the top. However, in a decentralized company where the power and the responsibility are shared, you will see cost and profit centers. The concept of a profit center is a framework to facilitate optimal resource allocation and profitability.

Key Differences

Profit centers require marketing, sales, production, and research and development resources to generate revenue and profits. The resources allocated to profit centers are intended to enable them to make strategic decisions, set prices, and manage costs to maximize revenue and profitability. Cost centers typically have limited resources allocated to them, as their primary taxpayers have more time to file in 2017 objective is to manage costs and expenses effectively. The resources allocated to cost centers are intended to support the provision of services and support to other parts of the organization cost-effectively. Cost centers are evaluated based on their ability to manage costs within budget while providing necessary support and services to other departments.

A cost center is a specific department, division, or unit within an organization that incurs costs but does not directly generate revenue. It is responsible for carrying out activities that support the organization’s overall objectives but are not directly tied to generating profits. Cost centers are typically found in organizations that have various functional areas, such as human resources, administration, or IT. By contrast, profit centers are any business units that directly generate profit. These include the sales departments and subsidiaries, which are responsible for managing both their own costs and profits.

A profit center may be better in sectors where revenue generation is vital, such as retail. Analyze profitability regularly to ensure that the profit center generates sufficient revenue to cover costs and contribute to the organization’s bottom line. Encourage innovation in profit centers to help them identify new revenue streams and expand their product or service offerings. It can be achieved through brainstorming sessions, ideation workshops, and other strategies. The impact of cost and profit centers on the balance sheet and cash flow statement can also differ.